How Do I Calculate Income Tax Coloring Pages

As you prepare your tax return it helps to understand how the tax law views your income and how to determine taxable income. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

4 2 Personal Income Tax The Taxman Taketh Mathematics Libretexts

4 2 Personal Income Tax The Taxman Taketh Mathematics Libretexts

Tax calculators make use of information related to your income deductions and HRA exemption and provide an approximate figure of income tax liability which arises thereof.

How do i calculate income tax coloring pages. These include Roth 401k contributions. It can be used for the 201314 to 201920 income years. Some deductions from your paycheck are made post-tax.

Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2020 to 5 April 2021. Tax credits and taxes already withheld from your. Dec 11 2020 The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages.

To do that follow the single-step or the multiple-step income method. It will help you as you transition to the new Form W-4 for 2020 and 2021. The Union Budget 2020 has left individuals confused with the choice of the tax regime.

What is your total salary before deductions. Online Income Tax Calculator. The 1099R I received has Unknown.

Jun 07 2019 I receive a monthly payment from my former spouses pension. Then we apply the appropriate tax bracket based on income and filing status to calculate tax liability. He is over 60 and retired - I am 48 and not retired.

As the user wants to calculate the taxable income and tax on the income. This is supposed to be a temporary relief provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020. Check your tax code - you may be owed 1000s.

With the help of the income tax calculator you can gauge the impact of both the tax structures on your income. This must be the entire amount. Popular Course in this category.

Keep in mind your income is part of what determines how much you owe in federal and state income taxes. Open MS Excel now go to Sheet1 where Ravis income details are available. 11 income tax and related need-to-knows.

SARS Income Tax Calculator for 2022 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. The changes to the tax withholding schedules announced in the Federal Budget 202021 are not reflected in this calculator as the 202021 calculator wont be available. Examples of amounts an individual may receive and from which the taxable income is determined include Remuneration income from employment such as salaries wages bonuses overtime pay taxable fringe benefits allowances and certain lump sum benefits.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. As the Taxable amount. Both old and new tax regimes require a proper assessment before choosing one.

Create two rows to calculate the taxable income and tax on the income. Jan 20 2021 No you do not need to pay back what you get for EIC if you chose to use 2019 earned income. Which tax year would you like to calculate.

To illustrate lets say your taxable income Line 10 on Form 1040 is 41049. I am not sure how much of the amount is taxable - andor if I need. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k.

Uniform tax rebate Up to 2000yr free per child to help with childcare costs. The tables only go up to 99999 so if your income is 100000 or higher you must use a separate worksheet found in the Form 1040 Instructions to calculate your tax. Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income.

An Income tax calculator is an online tool which is designed to help you with tax calculations. Nov 14 2020 Calculate Your Net Income Today. Jan 07 2013 This post will break down the details of how to calculate taxable income using these steps.

Marriage tax allowance Reduce tax if you wearwore a uniform. Income tax is the normal tax which is paid on your taxable income. Tax-free childcare Take home over 500mth.

Jan 01 2020 How Income Taxes Are Calculated. Calculating your net income is crucial especially when you need to compare last years earnings to this year. The money for these accounts comes out of your wages after income tax has already been applied.

I have not withheld any taxes from these payments although 150 of my monthly disbursement is applied to my survivor benefit. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Calculate Income Taxes for FY 2020-21.

If your earned income was higher in 2019 than in 2020 you can use the 2019 amount to calculate your EITC for 2020. After all its important to determine if your profits increased or decrease before tax season begins. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Free tax code calculator Transfer unused allowance to your spouse.

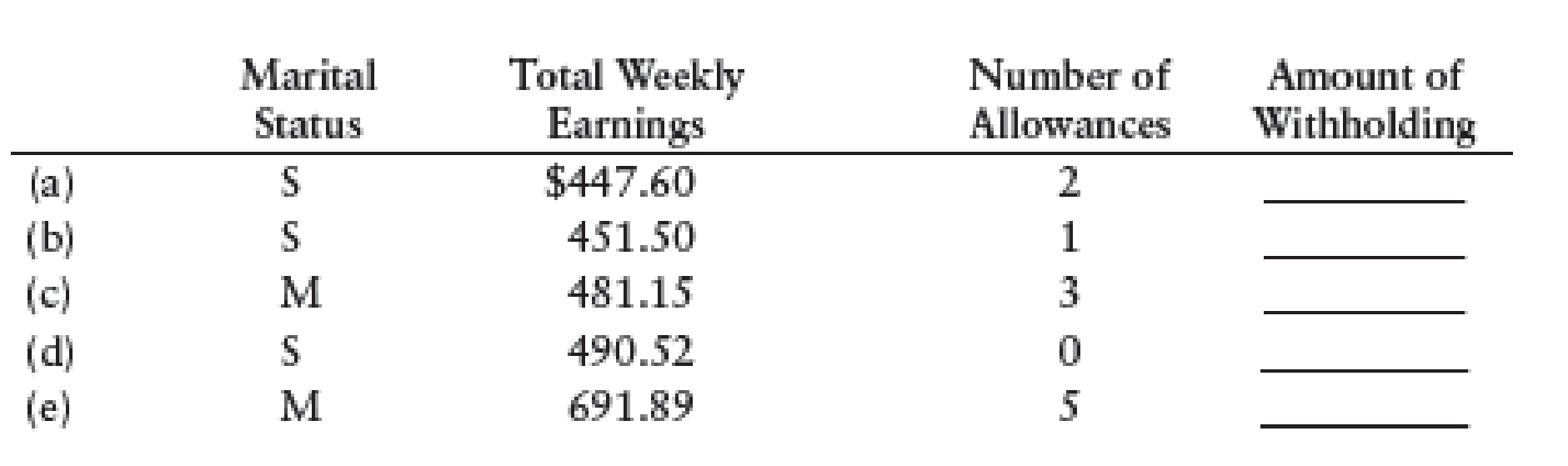

Computing Federal Income Tax Using The Table In Figure 8 4 On Pages 288 And 289 Determine The Amount Of Federal Income Tax An Employer Should Withhold Weekly For Employees With The Following

Computing Federal Income Tax Using The Table In Figure 8 4 On Pages 288 And 289 Determine The Amount Of Federal Income Tax An Employer Should Withhold Weekly For Employees With The Following

Income Tax Rate In Italy The Ultimate Guide

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

2021 Cfa Level I Exam Cfa Study Preparation

2021 Cfa Level I Exam Cfa Study Preparation

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Calculation Of Personal Income Tax Liability Download Scientific Diagram

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

How To Calculate Your Federal Income Tax Refund Tax Rates Org

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Calculation Of Personal Income Tax Liability Download Scientific Diagram

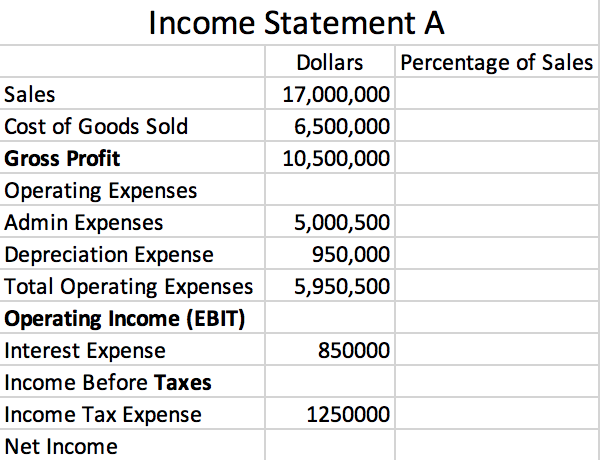

Solved Calculate Operating Income Ebit Income Before T Chegg Com

Solved Calculate Operating Income Ebit Income Before T Chegg Com

Income Tax Calculation Formula With If Statement In Excel

Income Tax Calculation Formula With If Statement In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Foreigner S Income Tax In China China Admissions

Solved Need Help Writing A Matlab Function The Simplest I Chegg Com

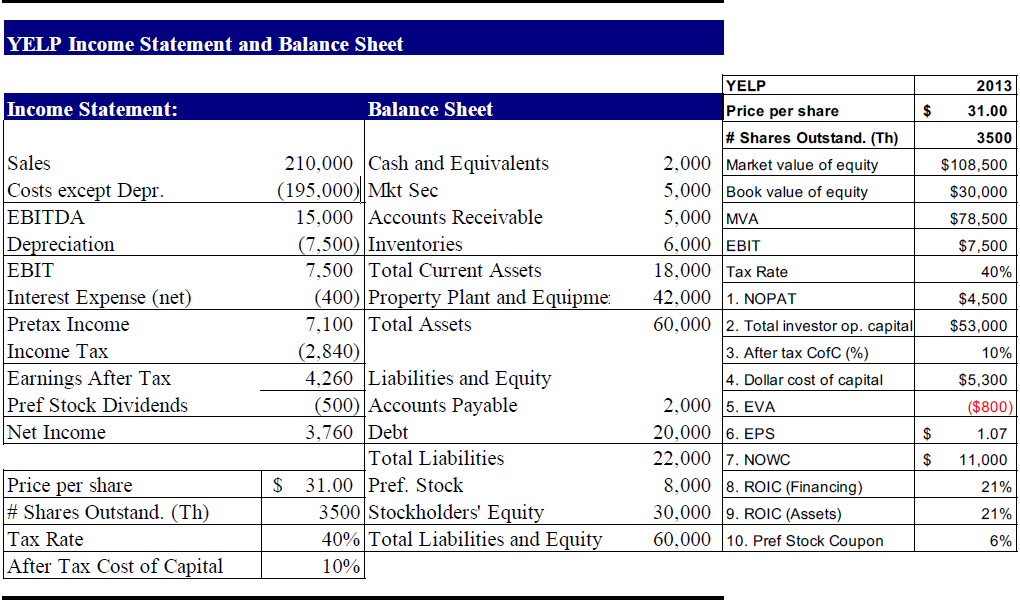

Solved How To Calculate Market Value Of Equity Book Valu Chegg Com

Solved How To Calculate Market Value Of Equity Book Valu Chegg Com

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

4 2 Personal Income Tax The Taxman Taketh Mathematics Libretexts

4 2 Personal Income Tax The Taxman Taketh Mathematics Libretexts